Lululemon Credit Card: Most people are busy in their daily life, like exercising, going to work, and being engaged in many more things. And if you are one of them, this detailed article about the Lululemo credit card article will give you all the details and best offers to save money.

We bring some latest offers, and valid for a few months only. So if you are a regular buyer of Lululemon products, then you must check out the offers listed below.

Contents

- 1 Amex Offer: Get $15/$25 Back with $150+ Lululemon Spend

- 2 Lululemon Credit Card Offers with Amex

- 3 Best 8 Alternatives of Lululemon Credit Card

- 4 1. American Express Blue Cash Preferred®

- 5 2. Alliant Visa® Signature Credit Card

- 6 3. Chase Ink Business Preferred®

- 7 4. Bank of America® Customized Cash Rewards Secured Credit Card

- 8 5. American Express® Gold Card

- 9 6. The Platinum Card® from American Express

- 10 7. Chase Sapphire Reserve®

- 11 8. Chase Sapphire Preferred®

- 12 Amex Offers

- 13 Why There Should Be A Lululemon Credit Card

- 14 Conclusion

- 15 Is there a Lululemon Credit Card?

Amex Offer: Get $15/$25 Back with $150+ Lululemon Spend

Amex Offer: You can get $15 to $25 cash back with $150+ Lululemon spent. And this offer is valid up to 7/-20-2023.

Lululemon Credit Card Offers with Amex

You can check out the following Amex promotions:

Promotion:

- Get $15 back w/ $150+ Lululemon Spend

- Get $25 back w/ $150+ Lululemon Spend

Expiration: 07-20-2023

Offer Terms

- These offers are valid only on the U.S. website shop.lululemon.com and the official mobile app.

- Valid only for U.S. currency dollar.

- Excludes strategic sales and B2B transactions. And the transactions made through the Lululemon brand ambassadors.

- If your shipping address is outside of the country, then it will not work.

- Offer not valid for the electronic items.

Bonus Tip: If you purchase from the Lululemon store, this can be the best deal for you.

Best 8 Alternatives of Lululemon Credit Card

If you randomly shop at Lululemon stores and want to earn reward points on your expenses, then a general rewards credit card is best for you.

The general rewards credit card helps you to earn reward points, cash back, and milestone benefits, and you can also avail of benefits on day-to-day expenses.

You can earn reward points at Lululemon stores and other places where the Visa card is accepted.

Then you can use your collected reward points on future expenses, buy gift cards, get discounts on travel tickets, and many more.

The offer can expire anytime, so try to benefit from the ongoing offer at Lululemon.

We will explore the general rewards credit cards so you can apply and take the benefits on your shopping.

Check this also: Onuu Credit Card – Benefits, Features

1. American Express Blue Cash Preferred®

PROS

- Get 6% cash back at a U.S. supermarket, up to $6,000 annually; afterward, you will get 1%.

- 3% at U.S. gas stations

- The card gives you purchase protection, secondary rental insurance, and an extended warranty*

CONS

- There is a 0% intro annual fee for the first year, then $95 per year.

- You will get 6% cash back at U.S. supermarkets if you spend $6,000 annually; the cashback will be only 1%.

2. Alliant Visa® Signature Credit Card

PROS

- There is no annual or foreign markup fee

- Qualifying customers get outstanding 2.5% flat rate cash back.

CONS

- There are too many requirements to qualify for the 2.5% cashback offer.

- There is no introductory offer.

3. Chase Ink Business Preferred®

PROS

- You will get 3x reward points on business-related expenses, online advertising, and other purchases

- You will get 25% additional reward points if you redeem on travel through Chase

- The credit card annual fee is only $95.

CONS

- You will not get any annual statement credits.

- For business purposes, the $150,000 limit is low on rewards.

Check this also: 10 Best Pet Care Credit Card

4. Bank of America® Customized Cash Rewards Secured Credit Card

PROS

- 3% cash back on the category of your choice

- Get 2% cash back on groceries and wholesale clubs like Sam’s and Costo

- You can deposit large amount (up to $4,900) to open an initial credit line

CONS

- $2,500 spending limit on special categories and then 1% cash back.

- This charges foreign transaction fees

5. American Express® Gold Card

PROS

- 4x reward points at restaurants and takeout plus delivery in the U.S.

- Get 3x reward points on a flight booking through amextravel.com

- Every month you will get $10 in Uber Cash for Uber Eats or Uber rides in the U.S. Every year, you can get $120 when you add your card to the Uber account.

CONS

- The annual of this credit card is $250

- There is no offer or benefit on supermarkets or warehouses

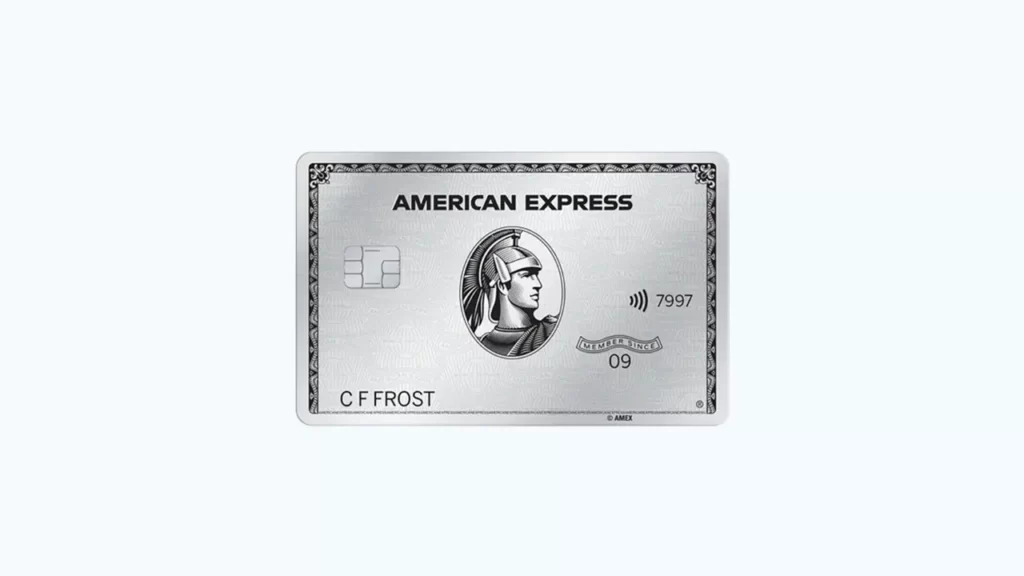

6. The Platinum Card® from American Express

Pros

- Luxury perks and protection services

- Get 5x reward points on prepaid hotels and flight booking through the American Express travel portal if you spend $500,000 per calendar year.

- Get hundreds of dollars in annual statement credits for airline fees, entertainment, fitness expenses, hotels, and more.

CONS

- There is a 0% introductory APR period

- The $695 annual fee of the card is the highest in the market

7. Chase Sapphire Reserve®

PROS

- On the account anniversary, you will get a $300 statement credit for a travel purchase.

- Get 10x reward points on hotel and rental car booking through Chase Unlimited Rewards.

- 5x regards point on a flight booking through Chase Ultime Rewards

- Get 50% additional reward points when you redeem for travel on Chase Ultimate Rewards.

CONS

- The $550 annual fee is high

8. Chase Sapphire Preferred®

PROS

- The credit card includes trip cancellation/interruption insurance and trip delay reimbursement.

- Get 25% additional regards points when you redeem for travel at Chase Ultimate Rewards.

- Get 10x bonus points on your account anniversary.

CONS

- No statement credit for Global Entry or TSA PreCheck

- There is no credit statement for Global Entry or TSA PreCheck

Amex Offers

Yes, some big names in the general saving credit card category will help you save on your Lululemon expenses.

Amex credit card is a great saving card; if you have an Americal Express account, then you have to apply for the Amex credit card.

The main benefit of Amex credit cards is they list the ongoing offers on their official website. With this, you can check out the best offers that suit you and save on your purchase.

And you will also find the Lululemon offers on the official website.

Americal Express Credit Cards are also a great option to save on purchases. If you have this credit card, then you can check the present offers listed on the official website of American Express.

Americal Express offers a variety of credit cards, and you can find these credit cards in the credit card section of the official website of American Express.

Why There Should Be A Lululemon Credit Card

Suppose Lululemon offers credit cards to its customers. In that case, it will be a great place for shopping and very convenient for everybody who wants to purchase anything from the Lululemon stores.

But there is no good news about the new credit card launching from Lululemon in the future.

If Lululemon launched a general saving credit card, you could save much more on your purchases because Lululemon gives some benefits to its regular customers.

We have the only solution for this, which is obtaining a general savings credit card. You can earn rewards on your Lululemon purchases and anything from the credit card.

Conclusion

The Lululemon store launched no credit card, which could be more pleasant for regular customers. The only solution to this is generally saving credit cards.

It isn’t very pleasant for the regular buyer of Lululemon wearers who want a brand new credit card to increase their savings.

But for now, you will have to look elsewhere.

If you already have a general savings credit card, you can check offers on the credit card’s official website. You can save some extra money.

If Lululemom launches any credit card in the future, we will update the article and provide you with all the information related to the Lululemon credit card.

But presently, there is no Lululemon credit card, and you must use your general savings credit cards.

Is there a Lululemon Credit Card?

No, there is no credit card launched by the Lululemon store. But you can apply for the general saving credit card and use it at the Lululemon store and get reward points.